Beginning July twenty vehicle allowances paid out by organizations are not allowed to be used as income. But now with PMI, banks will choose financial loans with incredibly lower down payments, often even 0% down. A accomplished copy of CRA Form T2200, Declaration of Conditions of Work, remains to be essential and has to be signed and Licensed by your employer acknowledging your requirement to use a car or truck for get the job done and fork out for a few (or all) in the costs. Expenses include managing prices and decline in price although not cash expenditures, which include the purchase price of the vehicle, the principal on any revenue borrowed to get it and any enhancement prices. The employee can then deduct the actual expenditures incurred to earn work money. With Clinton, the tax bracket for your prosperous (over two hundred,000 one, 250,000 married) was 36-39.four%. When Bush cuts had been in impact, the wealthy have been however able to lessen their taxes as much as 39.four%, which might, if they had adequate dollars to rent a really great tax preparer, earnings off The federal government.

Social Stability insurance plan is funded by contributions levied on both employer and employee and will be thought of a form of pension, but won't originate from the final tax foundation. Yet, it will respond to numerous thoughts and allow you to realize the tax implications of employer- and staff-presented automobiles. Distinctive policies might utilize to cars and trucks presented for disabled workers. The optional conventional mileage costs for healthcare and going expenditures drops from 23 cents for 2015 to 19 cents per mile for 2016, a lower of four cents and, yet again, the lowest level in five years. Though the lower cost of gasoline is a significant Consider the mileage price, other fastened and variable fees, which include depreciation, enter the calculation. Cellular personnel incur a wide array of expenses because they drive, from gas and maintenance expenditures to insurance coverage rates and depreciation, and they must be repaid appropriately.

Federal workers touring on official small business will be able to shell out much more on The federal government's dime beginning upcoming month in The big apple and San Francisco among other spots. Notice 2016-seventy nine clarifies in more element the regular mileage premiums, the amount a taxpayer ought to use in calculating reductions to basis for depreciation taken beneath the business normal mileage level, and the maximum typical automobile Value that a taxpayer may use in computing the allowance beneath a hard and fast and variable price system. Bad higher education students can obtain "Pell Grants" - dollars to pay for school fees that originates from the final tax base and is not acquired by the student. Also, the set expenditures of company journey , which include the price of auto insurance premiums and taxes, vary noticeably by place.

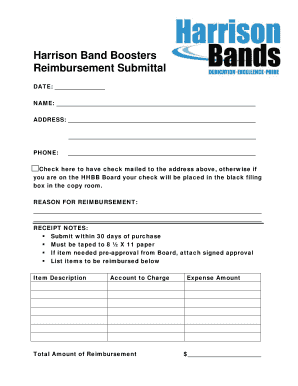

Now, I uncover it unusual that that organization would reimburse you, a self used human being, automobile and food fees, as that apply normally relates to an employee. An employer could prefer to use the applicable motor vehicle style price for each kilometre revealed above for calculating the tax-free of charge number of an staff's reimbursement. A separate restriction prorates deductible lease fees wherever the worth from the automobile exceeds the funds Price tag ceiling. I mentioned this issue with Craig Powell, CEO of Motus , Motus delivers a auto management and reimbursement platform that assures reasonable and exact reimbursements for cellular workers. The unreimbursed mileage deduction was allowed as well as other "unreimbursed work-linked charges" where all unreimbursed work associated expenditures in excessive of 2 percent of gross earnings could be deductible.

When experienced personnel are tricky to find for the duration of financial expansions, employers usually tend to present competitive premiums of reimbursement. For allowances paid to workforce that include accommodation in addition to meals and incidentals, use the exempt accommodation allowance premiums. The limit about the deduction of tax-exempt allowances which can be compensated by companies to workers who use their particular automobile for small business uses for 2017 will remain at 54 cents for each kilometre for the first 5,000 kilometres driven, and forty eight cents for every kilometre for each additional kilometre. In this instance, any employer reimbursement that is definitely compensated to you must be included in your cash flow. But this technique would not account for the fact that no two enterprise excursions are the exact same, so no two employees ought to be reimbursed precisely the same total.

This publish will go above the vehicle allowance premiums, car Added benefits and what this means in your taxes. The business enterprise regular mileage price is actually a substitute for all the costs of an automobile for business use, including depreciation, routine maintenance and repairs, and gasoline. The reasoning is that if the credit card is compensated off, the credit history line however exists plus the borrower can operate up financial debt following the mortgage is closed. A car allowance is more cash to offset expenditures you incur by driving your individual auto for enterprise actions. Lenders require to make sure You can find adequate income to the proposed mortgage loan payment, following other revolving and installment debts are paid. When general public transportation or simply a privately owned car or truck is just not obtainable or economical, a government ventedirectedemavoituremaintenant.be/blog/la-centrale-vendre-une-voiture motor vehicle is the 1st decision.

Toby can declare costs of $ten,096 for using his automobile for company purposes. There isn't any GST implications for kilometre premiums for self-utilized individuals and staff reimbursement. While auto allowances are effortlessly reported to your IRS, they increase an organization's Federal Insurance Contributions Act (FICA) tax legal responsibility drastically far more than other reimbursement solutions, which may be paid tax-free. The foundations also permit employees to assert specific deductions if they use their own individual cars in carrying out their work responsibilities. The regular mileage level for small business is based on an once-a-year examine from Le Bon Coin the preset and variable charges of operating an auto, like depreciation, insurance coverage, repairs, tires, routine maintenance, gasoline and oil. This is probably going to have an impact on transferring workers on the lookout to get homes in better price of housing areas.

This perceived complexity in accounting for different expenses ventedirectedemavoituremaintenant.be/blog/la-centrale-vendre-une-voiture can appear mind-boggling, and countless firms transform to an easier motor vehicle allowance, believing that this Answer is good enough.” However the drawbacks of car allowances more than offset the simplicity. About four hundred Non-Typical Regions”-primarily key metropolitan cities and counties-have higher charges depending on a formulation, which GSA generates in consltation Using the lodging industry, that accounts for rental values, time of calendar year and residence values. But, correctly recording each of the set and variable costs is usually elaborate to administer  And that's why most companies Do not use it. Charge per mile (CPM) is yet another technique for reimbursing staff members' vehicle charges, but "CPM programs have to meet IRS reporting needs, and deductions is usually fewer predictable without the need of exact mileage seize," Koppensteiner-Reidy mentioned.

For federal applications, if an employer pays or reimburses an personnel's Expert dues because membership from the association is of profit on the employer, the amount is not really a taxable reward for the employee. That has a automobile allowance the most typical route preferred by staff is usually to enter into a PCP settlement. We've manufacturer our financial loan providers give to match our customers, Should you be seriously in will need of private financial loan, company financial loan, house loan loan, auto personal loan, house bank loan, and large amount more check out us now for quick funding. The deductible organization mileage level is growing one cent for every mile as of Jan. Accepted mileage allowance payments are paid out when an staff does not receive a auto allowance Using these fees including the cost of working an auto, such as, insurance, upkeep and so forth, together with the gasoline costs.

Exactly where a personal stopover is provided on a visit to Canberra or A different destination inside entitlement, any extra airfares or other fees incurred are classified as the obligation of the worker and needs to be paid direct to Hogg Robinson Group (HRG) at time of creating the reserving. By way of example, an employer may well fork out a flat level allowance for driving within the metropolis wherever the business is based. He demonstrates an excellent organization perception. Frequently, it is taken into account reasonable if workers receive their advance within 30 times of the time that they incur the costs, adequately account to the bills in sixty times following the bills ended up paid out or incurred, and return any quantities in surplus of bills in one hundred twenty times following the expenditures have been paid out or incurred. Cellular apps to automate worker mileage tracking and accurately account for each employee's exact business, commute, and private miles.